Business Leaders Discuss Details of ‘Step Up Oklahoma’ Plan

<p>A coalition of business and community leaders released details Thursday of a plan they say will fix the state's budget problem and put the state on a strong financial fitting. However, the next step will be to sell it to lawmakers. A nonpartisan group of business and community leaders calling themselves Step Up Oklahoma is proposing the largest tax plan in state history. They said it's a hard pill to swallow, but it's the only way to get Oklahoma out of the financial crisis it's in. ...</p>Thursday, January 11th 2018, 1:52 pm

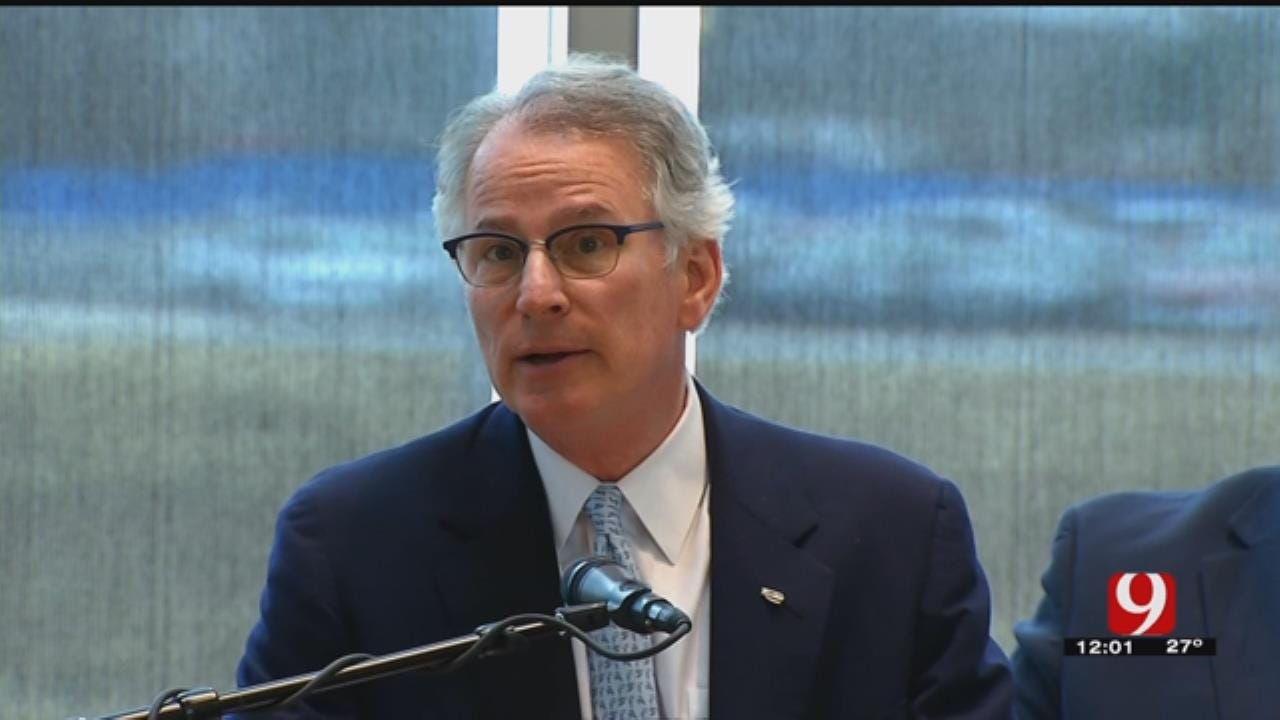

A coalition of business and community leaders released details Thursday of a plan they say will fix the state's budget problem and put the state on a strong financial fitting. However, the next step will be to sell it to lawmakers.

A nonpartisan group of business and community leaders calling themselves Step Up Oklahoma is proposing the largest tax plan in state history. They said it's a hard pill to swallow, but it's the only way to get Oklahoma out of the financial crisis it's in.

The leaders met with the press Thursday after weeks of meetings with legislative leaders and the governor. Their plan is two-fold: a combination of reforms in state government and increases in revenue.

Related Story: 1/11/2018 Community, Business Leaders Make Call For Reform Before Legislative Session

On the reform side, the group wants to raise teacher pay by $5,000, establish a stabilization fund for when the state has bad financial years. Also, the reforms would make the governor and lieutenant governor running mates, and they would create an independent budget office to help eliminate waste.

On the revenue side, the plan calls for $800 million in tax increases, including taxes on tobacco and e-cigarettes, energy (including the gross production tax), motor fuels and personal income tax. This would include a personal income tax increase that would affect 45 percent of Oklahomans.

The group answered questions from reporters, including if it they thought lawmakers would back tax increases, especially in an election year.

"I don't want to be realistic. I want to be idealistic." said BancFirst Executive Chairman David Rainbolt. "And I do think there's a core at the legislature and, really, all legislators who want to fix this problem."

Editor's note: David Griffin, president and chairman of Griffin Communications, parent company of News 9, is a member of Step Up Oklahoma. To learn more about the plan, visit StepUpOklahoma.com.

More Like This

January 11th, 2018

April 7th, 2025

April 7th, 2025

Top Headlines

April 7th, 2025