Actions Of State Lawmakers Will Impact Every Oklahoman

<p>A lot of news coming out of the Capitol Monday; news that will have an impact on every single Oklahoman. </p>Monday, November 6th 2017, 8:39 pm

A lot of news coming out of the Capitol Monday; news that will have an impact on every single Oklahoman.

The Senate passed a bill to bridge the state’s $215-million budget deficit; one state agency is asking for more money because it mismanaged what was budgeted; and the state’s credit rating has dropped because of lawmakers’ poor decisions.

Republicans and Democrats in the Senate agreed to a measure that would raise the tax on cigarettes by a dollar fifty a pack; raise the tax on fuel by six cents a gallon and increase the tax on beer. It would also raise the tax on oil and natural gas production for new wells, measures that have died in the House of Representatives.

“We are confident that this measure is constitutional in the way we amended it,” said Senator Greg Treat (R) Majority Floor Leader.

Senate Democrats agree with Republicans, we’ve run out of other options.

“Our other option is cuts. So far, we’ve cut the wic program, the advantage waiver, we’ve reduced the transportation 8-year plan,” said Senator John Sparks (D) Minority Leader.

Meanwhile, the State Department of Health is asking for 30-million more dollars after the agency reportedly misappropriated money for years.

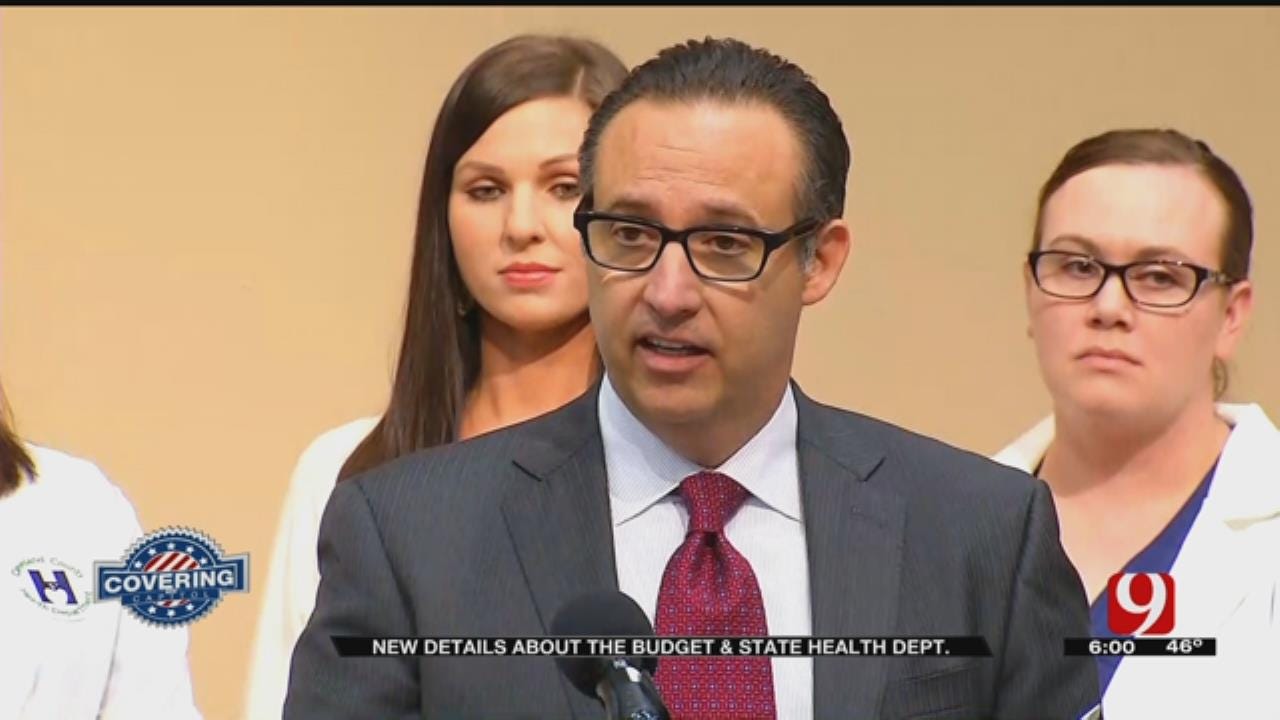

“And have identified over expenditures beyond the agencies annual revenue from approximately 2011 to the current fiscal year,” said Interim Health Director Preston Doerflinger.

Department heads, we’re told, for years have been shifting money from one budget to another to cover costs, and cooked the books to cover their tracks.

“These actions were able to go undetected by the Oklahoma state department of health, submitting budgets to OMES and others which appeared to be balanced,” Doerflinger said.

Legislative leaders say they’re looking at the request. The governor, meanwhile, hopes the House takes a serious look at the Senate budget plan.

“Let’s bring this session to an end, let’s find a way forward for our state, lets fund these core services for our people, show the people that we can get our job done,” Governor Fallin said.

The governor also said Moody’s Investor Service gave the state a “Credit negative rating” because of the inability to solve the budget problems, and the plan to raid reserves to bridge the budget gap. She says that will lead to higher interest rates when we borrow money.

Monday evening, Oklahoma Independent Petroleum Association President Tim Wigley released the following statement regarding the Oklahoma Senate’s approval of an increase in the state’s gross production tax:

We are disappointed in the Senate’s continued efforts to increase taxes on this state’s defining industry. In their zeal to place a greater burden on the state’s largest single taxpayer, Senators have put investment in this state’s oilfields and the jobs of working Oklahomans in jeopardy.

The Senate’s action follows years of industry concessions in 2010, 2014, 2016 and in this year’s regular legislative session that removed every tax incentive utilized by Oklahoma oil and natural gas producers to attract investors to the state’s historic oilfields. It also comes three days after State Treasurer Ken Miller announced gross receipts to the treasury are up by double-digits for the first time in four and a half years, with the gross production tax up 48 percent from year-ago levels.

Put in place by legislators in 2014 to replace a tax system created in 1994, Oklahoma’s current gross production rate is set at 2 percent for the first 36 months of production and 7 percent thereafter. The tax rate was championed by state senators and representatives, many of whom are still in office today, because they understood a growing and vibrant oil and natural gas industry equals a growing and vibrant Oklahoma economy.

The Senate’s tax increase on the oil and natural gas industry is greater than any tax increase this industry has seen since disgraced Gov. David Hall tax increase on the industry in 1971. The continued attack on tax policy that has drawn billions of dollars of investment capital into the state’s oil and natural gas industry will only reduce our state’s ability to attract new drilling and will stymie the economic growth driving treasury collections.

Founded in 1955, the OIPA is the state’s largest oil and gas advocacy group, representing more than 2,400 members in the crude oil and natural gas exploration/production industry or affiliated businesses.

More Like This

November 6th, 2017

November 13th, 2024

October 28th, 2024

October 17th, 2024

Top Headlines

December 26th, 2024

December 26th, 2024

December 26th, 2024

December 26th, 2024