Poll Shows Oklahomans Favor Controversial Tax At Heart Of Budget Debate

<p>Days ahead of the recently called special legislative session, new poll numbers are citing a dominant majority of Oklahomans are in favor of a controversial tax at the heart of this year’s budget debates.</p>Wednesday, September 20th 2017, 10:38 am

Days ahead of the recently called special legislative session, new poll numbers are citing a dominant majority of Oklahomans are in favor of a controversial tax at the heart of this year’s budget debates.

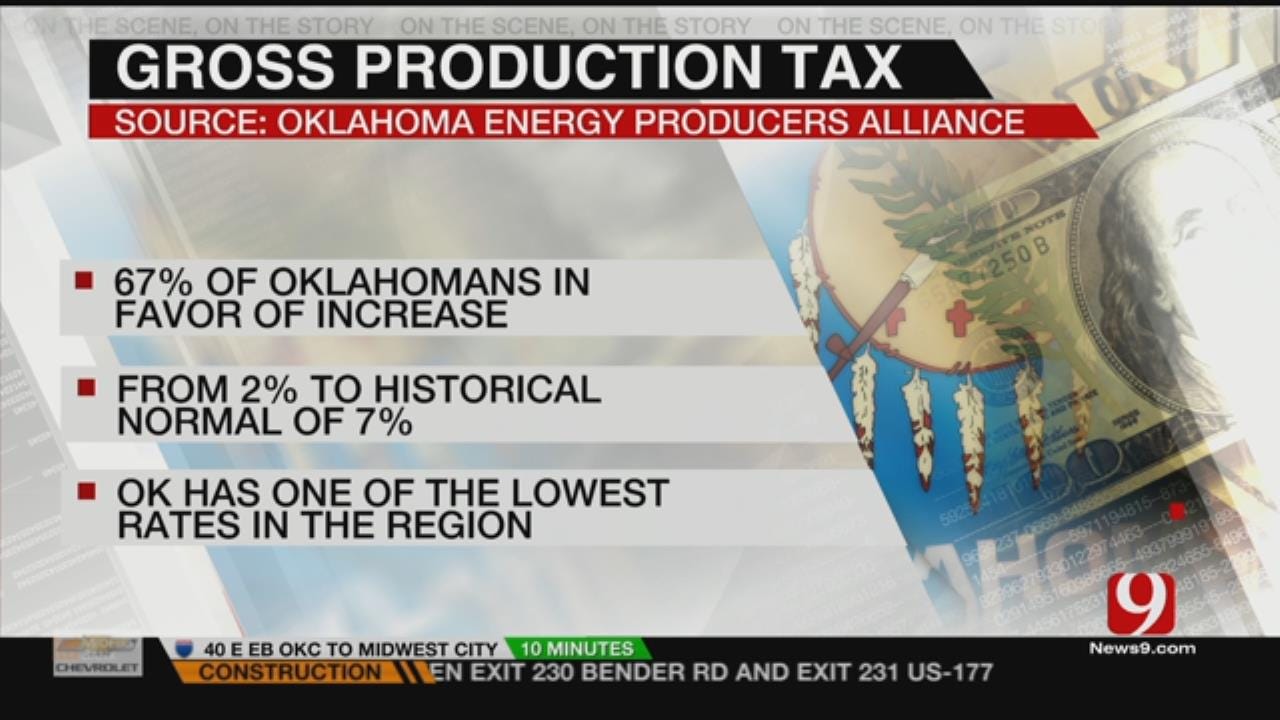

The poll, put out by the Oklahoma Energy Producers Alliance, shows 67 percent of Oklahomans are in favor of raising the Gross Production Tax (GPT) on oil and gas production from two percent to seven percent.

Historically, 7 percent was the state set tax. The GPT was originally lowered to create incentives for wildcat drillers and oil companies to bring business to Oklahoma.

During the 2017 regular legislative session the tax was at the heart of bitter political debate and raucous protesting. The split, pitting many Democrats and protesters against Republicans, showed divisions on how lawmakers wanted to fill the state’s nearly billion-dollar budget shortfall.

“The incentives have worked very well,” OEPA Board Member and oil executive Dewey Bartlett Jr. said. “Now is the time to stand up and say hooray and we're glad we're given these incentives because it worked, but now let's incentivize everybody by being fair and having the tax be equal for everybody.”

The GPT cut affects large oil companies drilling new wells, but does not apply to all smaller oil and gas producers, like Bartlett’s company. Representatives for larger energy companies disagree with Bartlett’s call for fairness.

“When Oklahomans are pressed, they don't want tax increases that will put at risk Oklahoma's slow economic recovery and the recent job creation,” Oklahoma Oil and Gas Association President Chad Warmington said in a statement.

Warmington cited recent ballot initiatives like State Question 777 that had initial public support but was later voted down as an example of shifts in public thinking.

It’s unclear if the GPT will be brought up as a topic of discussion at the recently ordered special session set to begin on Monday. Lawmakers have been tasked to replace hundreds of millions of expected dollars that will no longer be heading to state coffers after a tax on the price of cigarettes was struck down by the state Supreme Court.

According to the Oklahoma Policy Institute, Oklahoma netted $513.6 million from GPT revenue in 2013.

More Like This

September 20th, 2017

November 13th, 2024

October 28th, 2024

October 17th, 2024

Top Headlines

January 14th, 2025

January 14th, 2025

January 14th, 2025

January 14th, 2025