Oklahoma Clergy Members Sign Petition Against Payday Loan Bill

<p>Area clergy have signed a petition, trying to block a bill that would expand what they call "Predatory lending" in Oklahoma.</p>Friday, March 10th 2017, 4:59 pm

Area clergy have signed a petition, trying to block a bill that would expand what they call "Predatory lending" in Oklahoma.

News 9 obtained a copy of the petition signed by clergy from metro areas of the state, asking lawmakers not to support a bill that would allow payday lenders to loan more money.

Elise Robillard got into what she calls a cycle of predatory loans that lasted for 20-years. It all started when she needed tires for her car.

"I got that loan. I was convinced that I would be disciplined and that I would pay it off, but the fact of the matter is an emergency comes up, whether I would have to pay for a doctor’s visit or I've got to pay for the kids trip somewhere," said Robillard, who used a payday loan.

And, she said, the folks who offered the payday loans made it easy to get more money, and hard to pay it back.

"They'll call you and say, ‘Hey, you know, I've got $185 waiting here for ya if you just come on down and re-up your loan. We can give you $185 today.’ And you start thinking about the needs that your kids have and the fact that you got to put food on the table and gas in the car and all the sudden it seems reasonable."

Robillard says she only escaped the cycle last summer when she filed bankruptcy. Now, a new bill in the state house of representatives would allow payday lenders to loan up to $1,500, instead of the $500 they can loan now, for up to 12-months at 17-percent monthly interest. That's a 204-percent annual percentage rate.

The bill's author says these aren't meant to be long-term loans.

"There are single moms with kids that when the refrigerator goes out, they need $800, they really can't find money anywhere else. There's not a bank that's going to loan them money and we're leaving that segment out," said Rep. Chris Kannady (R-Dist. 91).

And Kannady says, the interest rate is fair because these are high-risk loans and the lenders have to make a profit to stay in business.

Clergy who signed the petition say the lenders prey on the poor.

"These products are designed to keep people paying that industry money. There is no way that folks can pay off the loan and the interest because the interest is so high," said Lori Walkae with the Mayflower Congregational United Church of Christ.

"I don't think that Oklahoma, our legislators, should be in the business of facilitating the pariah businesses that are really feeding off the poor in Oklahoma," said Robillard.

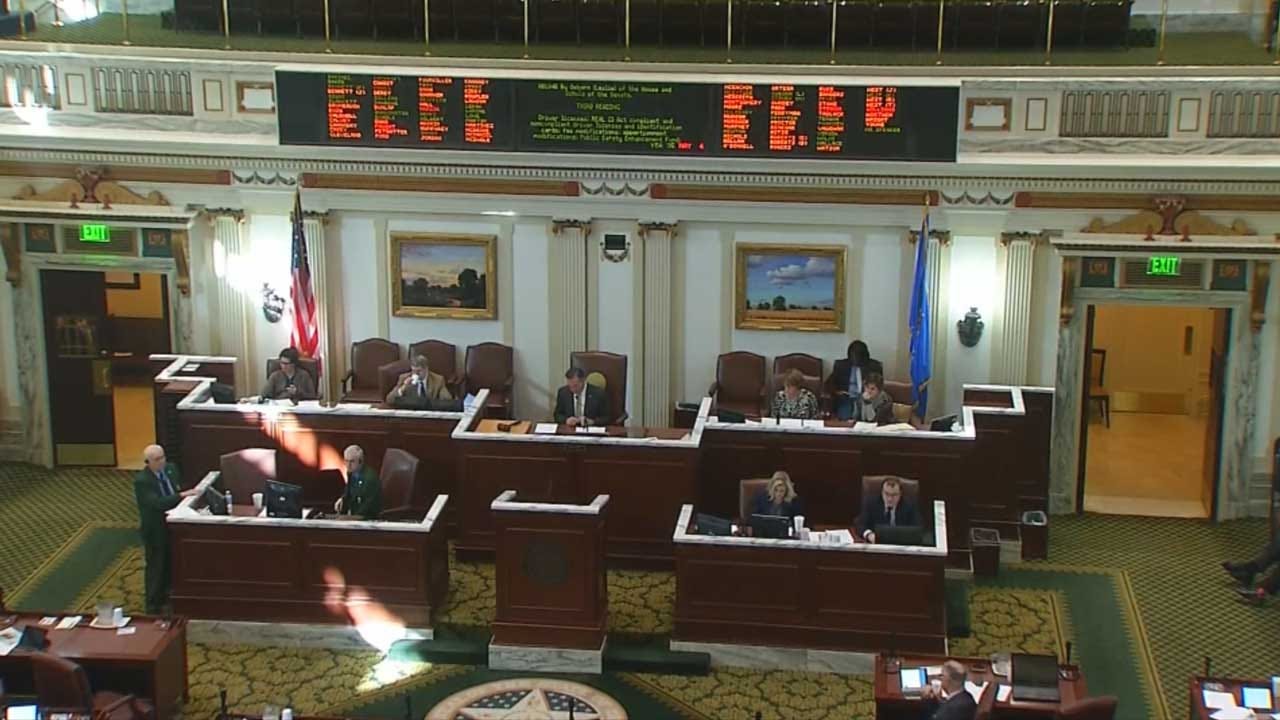

The bill passed out of committee 8-to-3 and heads for the house floor.

More Like This

March 10th, 2017

November 13th, 2024

October 28th, 2024

Top Headlines

March 27th, 2025

March 27th, 2025

March 27th, 2025