Harold Hamm Continues Positive Predictions On Oil And Gas Industry

<p>First Chesapeake Energy announced nearly 100 more layoffs at its manufacturing affiliate, and then Devon reports a $3.1 billion first quarter loss. But one oil tycoon is staying positive through it all.</p>Wednesday, May 4th 2016, 9:04 am

The hits just keep on coming for the oil and gas industry.

First Chesapeake Energy announced nearly 100 more layoffs at its manufacturing affiliate, and then Devon reports a $3.1 billion first quarter loss. But one oil tycoon is staying positive through it all.

In an op-ed in the Journal Record, Continental Resources' Harold Hamm does not shy any from any bold statements about the current status of his industry.

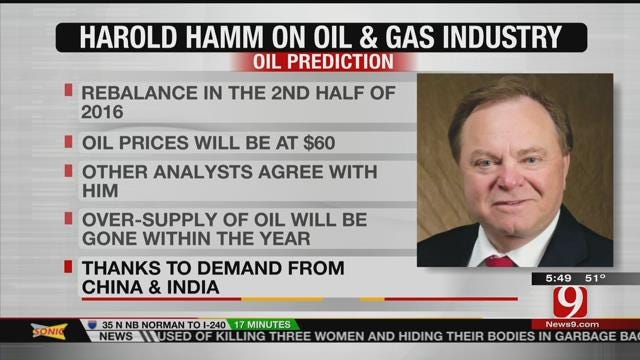

First Hamm writes OPEC is now irrelevant. He says OPEC's "artificial pricing tactics have been replaced by the true market fundamentals of supply and demand.” So now he feels the global oil market is stabilizing, which means in his opinion, the market will re-balance in the second half of 2016 and oil prices will be at $60.

That is the same statement he made in January. Only this time he says many other analysts agree with him, citing some even feel oil will be higher than $60.

As for the over-supply of oil, he says that will be gone within the year thanks to demand from China and India.

However, other analysts strongly disagree with Hamm. The same day his op-ed was published, CNBC reported that even though oil is above $45 now, it’s unlikely prices will even reach $50.

More Like This

November 13th, 2024

October 28th, 2024

October 17th, 2024

Top Headlines

January 14th, 2025

January 14th, 2025

January 14th, 2025

January 14th, 2025