Unexpected Ways To Hurt Your Credit Score

<p>There’s a good chance you know the big line items that can tank your credit score -- bankruptcy, foreclosures. But there are some other ways you may not be aware of.</p>Monday, April 11th 2016, 9:48 am

There’s a good chance you know the big line items that can tank your credit score -- bankruptcy, foreclosures. But there are some other ways you may not be aware of.

The exact effects will vary depending on your full credit profile but experts say you need keep in mind a few unexpected factors that could kill your credit-score.

Closing all your credit cards. Experts say your intentions may be good, but closing all your credit card accounts at once could severely damage your credit utilization rate, which is the amount of debt you are carrying versus how much credit has been extended to you.

Experts say you may want to keep a card or two open to minimize the damage to your score.

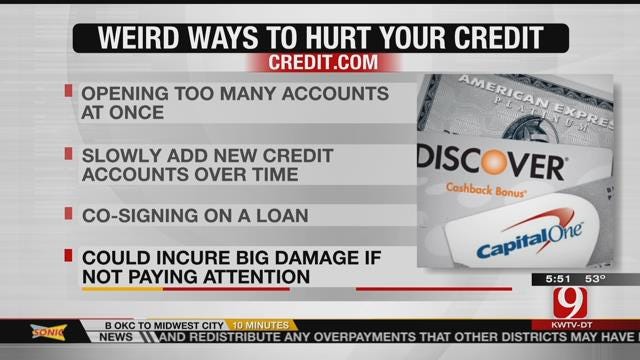

Also don't open too many accounts at once. Experts say you want to slowly add new credit accounts over time.

And lastly, co-signing on a loan. Experts say co-signing on a loan will not hurt your credit, but you could have big damage if you stop paying attention to the account and the person you co-signed for.

Experts say that no matter how the damage gets done, there's are ways to fix your credit. You can generally improve your scores by paying down high credit card debts and building long-term smart spending habits.

More Like This

April 11th, 2016

November 13th, 2024

October 28th, 2024

October 17th, 2024

Top Headlines

December 26th, 2024

December 26th, 2024

December 26th, 2024

December 26th, 2024