9 Investigates: The High Cost Of Homeowner's Insurance In Oklahoma

Oklahoma usually gets high marks for having a low cost of living, but that's not as true as it used to be, thanks to homeowners insurance rates that are going through the roof.Monday, November 4th 2013, 9:20 pm

Oklahoma usually gets high marks for having a low cost of living, but that's not as true as it used to be, thanks to homeowners insurance rates that are going through the roof.

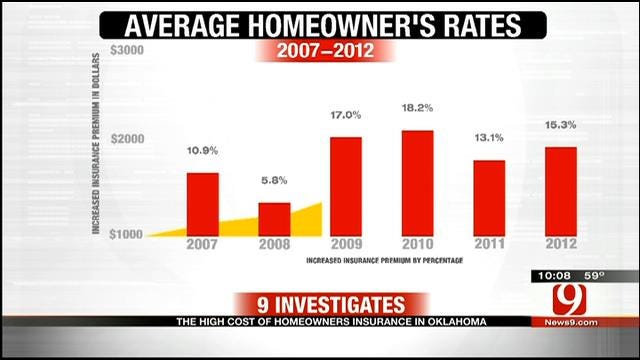

In the last six years, premiums in Oklahoma have more than doubled, and Oklahoma now has the highest average homeowners insurance rates in the country.

Louisiana had been leading the way, thanks, in part, to the devastating effects of Hurricane Katrina. Hurricanes are one type of natural disaster, against which Oklahomans don't have to insure their homes.

But perhaps the only one.

"It's pretty much, unfortunately, a red dot over the whole state," remarked John Wiscaver, a spokesperson for Oklahoma Farm Bureau Insurance.

The list of potential threats is long: tornadoes, hailstorms, straight line winds, wildfires, ice storms, flash flooding, and even earthquakes. And those in the business say the disasters are happening with greater frequency.

"All of those things have occurred in the last ten years from an exposure standpoint," said Wiscaver, "which has significantly impacted the overall cost of doing business in this state."

As a result, from 2007 through 2012, Oklahoma consumers saw double-digit increases in average homeowner's rates each year except 2008. In that period, a homeowner who started out paying $1,000 would now be paying more than $2,100.

And, in the wake of all the well-publicized storms this past spring, it seems the upward trend is only continuing.

Michelle Mohler and her husband live in southwest Oklahoma City. Their home is not in an area that was affected by the May storms and they've never filed a claim. And so they were shocked when they recently called their agent and asked if their rates would be going up.

"She said, we already have it, it's going up 34 percent," Mohler said, "and I asked her why, and she said that's just-- she blamed it on the tornadoes."

Mohler says they had been paying $2,464, and now we're going to have to pay $3,292. She says the $800 increase is too much and they are likely to switch carriers.

"They're just raising it because they can," said an exasperated Mohler.

Oklahoma Insurance Commissioner John Doak doesn't see it quite the same way.

"What we're seeing is there are a few carriers that are taking rate increases," Doak told us.

In Oklahoma, insurers abide by a 'file and use' system -- they file plans for rate changes and then use them. Commissioner Doak says the marketplace determines rates, not him. He says, while our rates may be high, people like the Mohlers can shop around, because the market is healthy, despite all the claims being filed.

"When we're looking at the Moore area and what's happened to Oklahoma here, with close to 100-thousand claims -- the largest catastrophe in Oklahoma history," Doak said, "our market is going to remain stable."

But it's also going to remain expensive.

It might seem logical that rates would be just as high in our neighboring states, where they also deal with severe weather and ice storms. But that is not the case. Louisiana is closest, with an average annual rate of $1,300. At $1,535 dollars, Oklahoma is, unfortunately, a clear number one.

See the rates for all 50 states.

See how the top 10 home insurers in Oklahoma have raised rates over the past five years.

More Like This

November 4th, 2013

April 8th, 2025

April 7th, 2025

Top Headlines

April 11th, 2025

April 11th, 2025