Should Tribal Members Be Exempt From Income Tax? Court Hears Case

“The question before this court is whether a tribal member is entitled to invoke the income tax exemption,” Kannon Shanmugam with the Oklahoma Tax Commission said.Wednesday, January 17th 2024, 5:50 pm

A case is being heard in court that could change who pays income taxes in Oklahoma. A woman is arguing that she has tribal sovereignty and wants a refund on her taxes.

Each side is presenting their interpretation of state law. Alicia Stroble’s side is arguing that sovereignty means no income tax, the Tax Commission says it’s more complicated than that.

“The question before this court is whether a tribal member is entitled to invoke the income tax exemption,” Kannon Shanmugam with the Oklahoma Tax Commission said.

Stroble is a Muscogee Creek Nation citizen living and working on tribal land, and she’s asking for a refund of back income taxes from the Oklahoma Tax Commission.

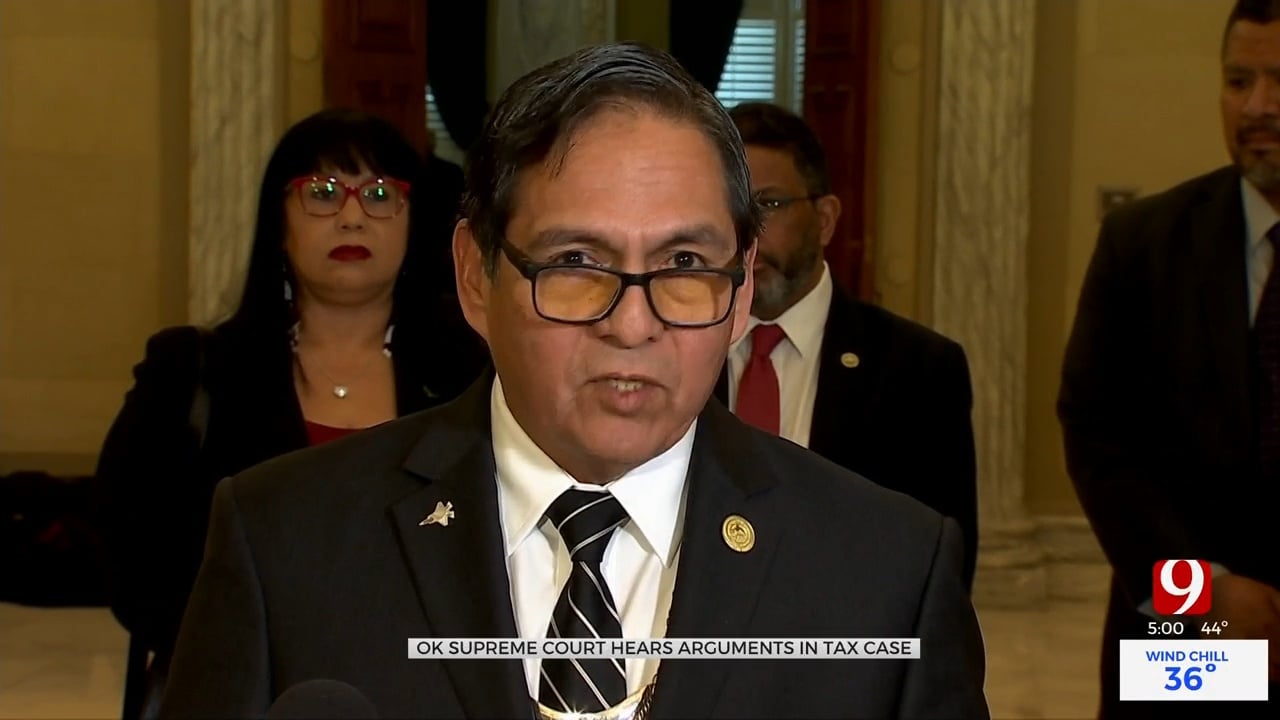

“Today it’s Alicia Stroble, tomorrow it will be someone else,” Muscogee Creek Nation Chief David Hill said.

Oklahoma law states that “[t]he income of an enrolled member of a federally recognized Indian tribe shall be exempt from Oklahoma individual income tax when: The member is living within “Indian Country” under the jurisdiction of the tribe to which the member belongs.”

“This case presents one of the most consequential questions to arise in the wake of the US Supreme Court’s decision in Mcgirt,” Shanmugam said.

The Tax Commission also argues this would set a dangerous precedent, saying the consequences could cost the state up to $75 million per year, if members of the big five tribes were all exempt from these state taxes.

“The critical point is, that is money that the state needs because the state is providing services across eastern Oklahoma,” Shanmugam said.

Attorneys for Stroble and the Muscogee Nation say the tribe also offers those services to people living on Muscogee Creek land.

“It should concern every citizen of Oklahoma that the state feels like it can pick and choose when to follow the law,” Hill said.

Oklahoma Governor Kevin Stitt shared this post on social media regarding the state income tax:

More Like This

January 17th, 2024

June 4th, 2024

May 29th, 2024

Top Headlines

March 21st, 2025