The Apple Card Is Sexist, Claims Apple Co-Founder Steve Wozniak

New York state's top insurance regulator is probing allegations of discrimination against females by the Apple Card after several husbands complained their wives were offered dramatically lower lines of credit than the men were.Tuesday, November 12th 2019, 10:32 am

New York state's top insurance regulator is probing allegations of discrimination against females by the Apple Card after several husbands — including Apple co-founder Steve Wozniak — complained their wives were offered dramatically lower lines of credit than the men were.

The claims surfaced on social media during the weekend after tech entrepreneur David Heinemeier Hansson tweeted that even though he and his spouse share assets and she has a better credit score, Apple Card offered him 20 times the credit limit.

In a series of tweets, Hansson did not reveal his or his wife's income, but noted they'd been married a long time, file joint tax returns and live in a community-property state where all assets acquired during a marriage are shared. Hansson tweeted that complaints about his wife receiving a much lower credit limit initially drew a muted response. When Apple Card did increase her credit limit without addressing the scoring system, it was basically attempting to "bribe one loud mouth on Twitter, then we don't have to actually examine our faulty faith in THE ALGORITHM," he tweeted.

Others chimed in with similar tales, including Wozniak, who said his limit was 10 times that of his spouse, even though all of their assets and accounts are shared.

"Some say the blame is on Goldman Sachs, but the way Apple is attached, they should share responsibility," Wozniak tweeted.

Apple did not immediately return requests for comment.

Goldman, however, issued a statement refuting the notion of gender being a factor in the company's credit decisions.

"We look at an individual's income and an individual's creditworthiness, which includes factors like personal credit scores, how much debt you have, and how that debt has been managed. Based on these factors, it is possible for two family members to receive significantly different credit decisions," a spokesperson emailed CBS MoneyWatch. "In all cases, we have not and will not make decisions based on factors like gender."

That said, Goldman is looking at letting customers share their Apple Cards with other family members, the bank added.

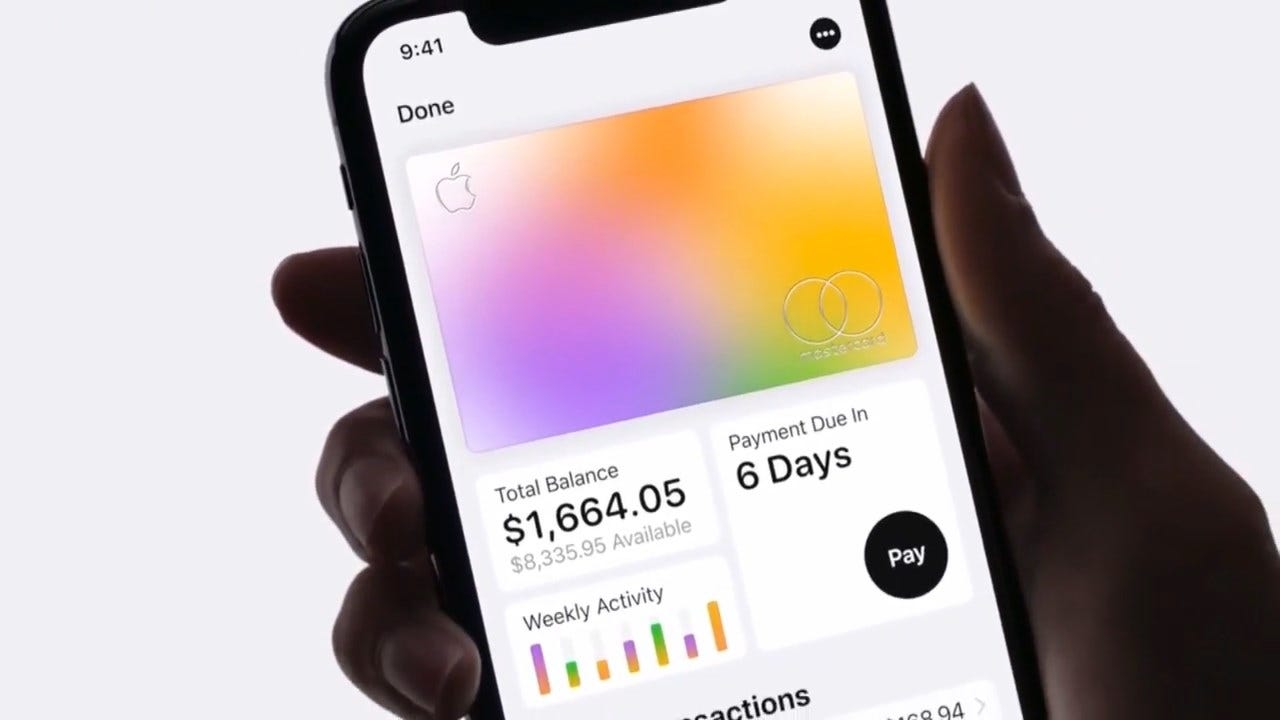

The brouhaha involves a product launched in August that partnered the tech giant's Apple Pay program and a recent move by Goldman to make inroads into the retail consumer credit market. The Apple-branded card was touted as one available to those who might otherwise find it difficult to get credit. But the claims illustrate the trouble in having artificial intelligence determine decisions like how much credit to extend, given studies suggest artificial intelligence as having a track record of showing bias in various scenarios.

Linda Lacewell, superintendent of the New York Department of Financial Services, said in a post Sunday on Medium that she "would examine whether the algorithm used to make these credit limit decisions violates state laws that prohibit discrimination on the basis of sex."

Lacewell's agency recently launched an investigation into reports that a UnitedHealth Group algorithm had prioritized care for healthier white patients over less healthy African-American ones, the DFS superintendent said.

Apple is not the only technology company accused of aiding in discrimination in accessing financial service. Facebook in March said it would overhaul its ad-targeting systems to prevent discrimination in housing, credit and job ads as part of a legal settlement.

undefined

Apple did not immediately return requests for comment.

Goldman, however, issued a statement refuting the notion of gender being a factor in the company's credit decisions.

\"We look at an individual's income and an individual's creditworthiness, which includes factors like personal credit scores, how much debt you have, and how that debt has been managed. Based on these factors, it is possible for two family members to receive significantly different credit decisions,\" a spokesperson emailed CBS MoneyWatch. \"In all cases, we have not and will not make decisions based on factors like gender.\"

That said, Goldman is looking at letting customers share their Apple Cards with other family members, the bank added.

The brouhaha involves a product launched in August that partnered the tech giant's Apple Pay program and a recent move by Goldman to make inroads into the retail consumer credit market. The Apple-branded card was touted as one available to those who might otherwise find it difficult to get credit. But the claims illustrate the trouble in having artificial intelligence determine decisions like how much credit to extend, given studies suggest artificial intelligence as having a track record of showing bias in various scenarios.

Linda Lacewell, superintendent of the New York Department of Financial Services, said in a post Sunday on Medium that she \"would examine whether the algorithm used to make these credit limit decisions violates state laws that prohibit discrimination on the basis of sex.\"

Lacewell's agency recently launched an investigation into reports that a UnitedHealth Group algorithm had prioritized care for healthier white patients over less healthy African-American ones, the DFS superintendent said.

Apple is not the only technology company accused of aiding in discrimination in accessing financial service. Facebook in March said it would overhaul its ad-targeting systems to prevent discrimination in housing, credit and job ads as part of a legal settlement.

","published":"2019-11-12T16:32:35.000Z","updated":"2019-11-12T16:49:54.000Z","summary":"New York state's top insurance regulator is probing allegations of discrimination against females by the Apple Card after several husbands complained their wives were offered dramatically lower lines of credit than the men were.","affiliate":{"_id":"5cc353fe1c9d440000d3b70f","callSign":"kwtv","origin":"https://www.news9.com"},"contentClass":"news","createdAt":"2020-01-31T18:09:54.850Z","updatedAt":"2022-03-30T20:14:17.857Z","__v":2,"breakingNews":[],"entities":[{"_id":"6244ba096880e45323a22eb5","text":"Steve Wozniak","type":"PERSON","__v":0},{"_id":"623b75b06880e4532377c8ad","text":"New York","type":"LOCATION","__v":0},{"_id":"623c59f76880e45323078391","text":"Apple","type":"ORGANIZATION","__v":0},{"_id":"623c44d36880e45323fb855a","text":"Twitter","type":"ORGANIZATION","__v":0},{"_id":"6243808b6880e45323b71655","text":"Goldman Sachs","type":"ORGANIZATION","__v":0}],"hasBeenCheckedForEntities":true,"openInNewWindow":false,"show":true,"link":"/story/5e346d72527dcf49dad6da5e/the-apple-card-is-sexist-claims-apple-cofounder-steve-wozniak","hasSchedule":false,"id":"5e346d72527dcf49dad6da5e"};More Like This

November 12th, 2019

November 13th, 2024

October 28th, 2024

October 17th, 2024

Top Headlines

January 10th, 2025

January 10th, 2025

January 10th, 2025