House Speaker Brings $78 Billion Bipartisan Tax Relief Bill To Floor For Vote

Despite lingering concerns from members on both sides of the aisle, House Speaker Mike Johnson (R-LA) is bringing a bipartisan tax bill to the floor for a vote Wednesday night under suspension of rules, meaning it will need a two-thirds majority to pass.Wednesday, January 31st 2024, 5:53 pm

WASHINGTON, DC -

Despite lingering concerns from members on both sides of the aisle, House Speaker Mike Johnson (R-LA) is bringing a bipartisan tax bill to the floor for a vote Wednesday night under suspension of rules, meaning it will need a two-thirds majority to pass.

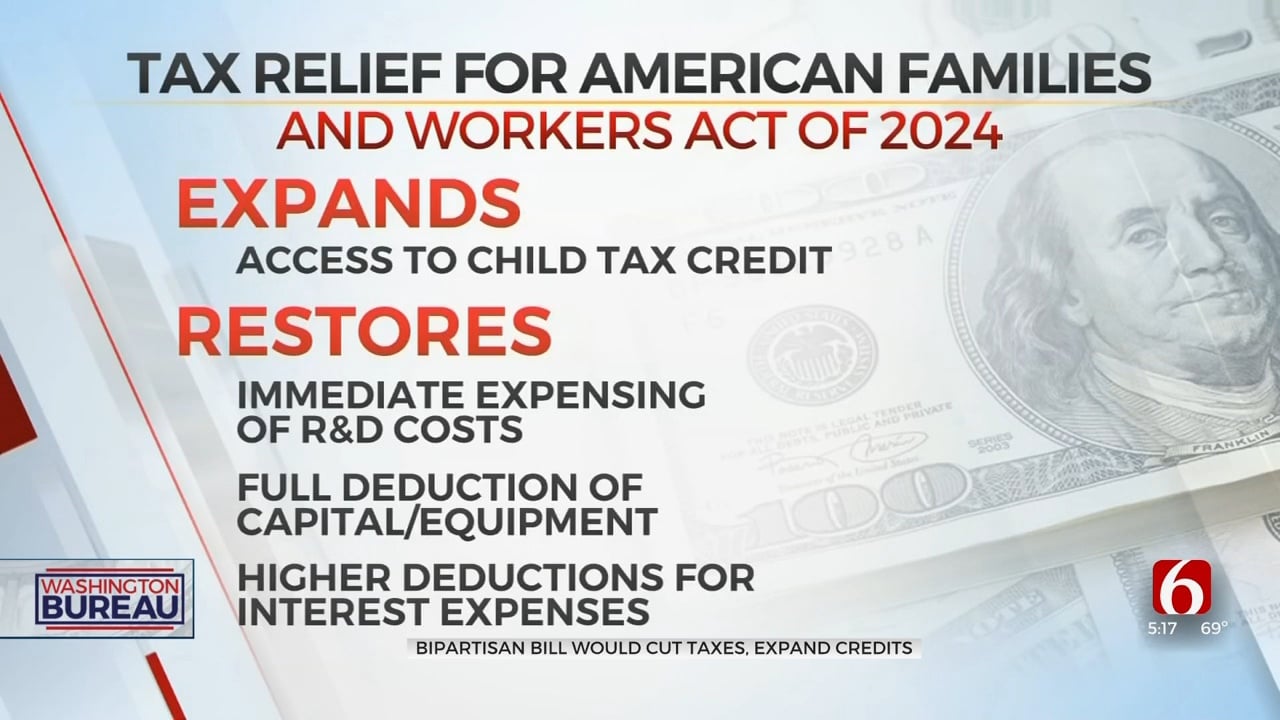

The $78 billion Tax Relief for American Families and Workers Act of 2024 would increase the child tax credit and retroactively restore business tax credits that were part of the 2017 Trump tax bill, but which recently expired.

Those include the immediate expensing of research and development and the full deduction of capital expenditures.

Oklahoma Congressman Kevin Hern (R-OK1), a member of the House Ways and Means Committee, has been advocating for the extension of the business tax credits and supports the bill’s passage.

“It’s really big for all of those companies that do research and development, and we have a lot of them,” Rep. Hern said in an interview Tuesday, “a lot of tech companies, a lot of aerospace companies in our state that do a lot of research and development, a lot of oil and gas companies that are always looking for new ways to cut emissions, or be more efficient.”

Hern says he's been pushing for this for two years, but it took the GOP winning the majority in the House last year to get Democrats to the table.

"You’re seeing an extension of the tax cuts that President Trump put in place," Hern explained.

In return, Democrats are getting some changes to the Child Tax Credit, which was temporarily increased during the pandemic and is credited with raising three million families out of poverty.

Since the increase expired, national poverty rates have increased, underscoring the current argument for expanding access to the CTC.

"The proposed changes to the tax credit would really benefit the lower 40 percent of earners," said CBS News Business Analyst Jill Schlesinger in a recent interview.

In addition to expanding the CTC, the bill would restore: the immediate expensing of research and development costs; the ability to deduct the full cost of capital investments and equipment costs; and the ability of businesses to deduct a higher percentage of interest expenses.

Hern says the $78 billion cost of the bill’s measures, which will expire with the rest of the 2017 tax cuts at the end of 2025, will be fully offset by ending the processing of the Covid-era Employee Retention Tax Credit claims three months early.

"So, there is actually a pay-for, which that in itself is historical," Hern noted.

Still, the bill has opposition on both sides of the aisle -- Republicans who don't want the Child Tax Credit expanded, Democrats who don't believe the bill would expand it enough, and New York Republicans who are upset that it does not address their concerns with state and local tax (SALT) deductions.

Hern says the good far outweighs any bad in the bill and says it's especially good for companies doing research and development.

"The immediate expensing is something like $70 billion to be put in play immediately," Hern said in the interview. "Companies being able to put assets to work, people to work, and that’s what we need -- we need to continue growing jobs and putting Americans to work."

The bill also has strong bipartisan support in the Senate.

More Like This

January 4th, 2025

January 4th, 2025

January 4th, 2025

Top Headlines

January 4th, 2025

January 4th, 2025

January 4th, 2025